Publications & presentations

THE MAJOR SOURCES OF DIRECTOR’s OBLIGATIONS

- common law and applicable legislation, including the Companies Ordinance and the Securities and Futures Ordinance (“SFO”);

- the Rules Governing the Listing of Securities on the Growth Enterprise Market of The Stock Exchange of Hong Kong Limited (the “GEM Rules”);

- the Code on Takeovers and Mergers and the Code on Share Buy-backs (“Takeovers Code”);

- the directors’ Declaration and Undertaking to the Exchange; and

- the Companies Registry’s Guide on Directors’ Duties.

DIRECTORS’S OBLIGTION TO ENSURE ISSUER’S COMPLIANCE WITH LISTING RULES

- A listed issuer undertakes in its application for listing to comply with the Listing Rules once its securities are listed on the Exchange.

- Under GEM Rule 17.03, the directors of a listed issuer are collectively and individually responsible for ensuring that the listed issuer complies fully with the requirements of the GEM Rules.

DIRECTORS’S DECLARATION AND UNDERTAKING

A director undertakes that he will:

- comply to the best of his ability with the GEM Rules and use his best endeavours to ensure that the listed issuer complies with the GEM Rules;

- comply to the best of his abilities with the requirements of the SFO, the Takeovers Code, the Code on Share Buy-backs, the Companies Ordinance and all other securities laws and regulations from time to time in force in Hong Kong and use his best endeavours to ensure that the listed issuer so complies; and

- cooperate in any investigation conducted by the Listing Division and/or the GEM Listing Committee of the Exchange.

FIDUCIARY DUTIES OF DIRECTORS

- Duty to act honestly and in good faith in the interests of the company as a whole

- Duty to act for a proper purpose

- Duty in relation to the assets of the listed issuer

- Duty to avoid actual and potential conflicts of interest and duty

- Duty to disclose fully and fairly his interests in contracts with the listed issuer

- Duty to apply such degree of skill, care and diligence as may reasonably be expected of a person with his knowledge and experience and acting as a director of a listed issuer (GEM Rule 5.01)

Duties summarised in the Companies Registry’s Guide on Directors’ Duties (Attachment A)

STATUTORY DUTY UNDER THE NEW COMPANIES ORDINANCE

Section 465(2) of the new Companies Ordinance (Cap. 622) adopts a mixed objective and subjective test for directors’ duty of skill, care and diligence. The standard of care, skill and diligence required is that which would be exercised by a reasonably diligent person with:

- the general knowledge, skill and experience that may reasonably be expected of a person carrying out the functions carried out by the director in relation to the company (the objective test); and

- the general knowledge, skill and experience that the director has (the subjective test).

Objective test in (a) is a minimum standard. The subjective test in (b) means that if director has special skill/knowledge, a higher standard is required.

- The directors of a non-Hong Kong company which is listed on the Exchange must comply with the statutory duty since they are required by GEM Rule 5.01 to exercise duties of skill, care and diligence to the standard set by Hong Kong law.

CONSEQUENCES OF NON-COMPLIANCE WITH THE GEM RULES

- If there has been a breach of the GEM Rules, the Exchange may:

- issue a private reprimand;

- issue a public statement which involves criticism;

- issue a public censure;

- report the offender’s conduct to a regulatory authority (e.g. the SFC) or to an overseas regulatory authority;

- require a breach to be rectified or other remedial action taken within a stipulated period;

- state publicly that in the Exchange’s opinion the retention of office by the director is prejudicial to the interest of investors; and

- take (or refrain from taking) such other action as the Exchange thinks fit. (GEM Rule 3.10)

If the Exchange considers the issuer failed in a material manner to comply with the GEM Rules, it can suspend dealings in, or cancel the listing of, the issuer’s securities (GEM Rule 9.01).

It is a criminal offence to intentionally or recklessly provide information which is false or misleading in a material particular in any public disclosure document filed with the Exchange or SFC (section 384 of the SFO). The maximum penalty is 2 years’ imprisonment and a fine of HK$1 million.

Under section 214 of the SFO, a person can be disqualified from being a director of any corporation for up to 15 years if he is wholly or partly responsible for the misconduct of a company’s affairs. Misconduct includes where shareholders are not given all the information re. the company which they might reasonably expect. In 2010, the SFC disqualified two directors for failing to inform the company’s shareholders that the company was in a substantially depleted financial position.

DIRECTORS’ LIABILITIES FOR MISSTATEMENTS IN PROSPECTUS

The Listing Rules require an issuer’s directors to take full responsibility for the contents of a prospectus. The prospectus must contain a responsibility statement which states that:

“the directors, having made all reasonable enquiries, confirm that to the best of their knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading.”

Untrue statements contained in a prospectus or the omission of material information (“Misstatements”) may result in criminal and/or civil liability for the issuer’s directors. The principal areas of liability include:

- Section 342E Companies (Winding Up and Miscellaneous Provisions) Ordinance (CWUMPO) – imposes civil liability for prospectus misstatements on specified persons (including directors)

- Section 342F CWUMPO – imposes criminal liability for prospectus misstatements on persons who “authorized the issue of a prospectus” (which may include the directors)

- Section 108(1) SFO – imposes civil liability for making any fraudulent, reckless or negligent misrepresentation which induces others to invest money

- Sections 277 & 281 SFO – impose civil liability for disclosing false or misleading information to induce dealings in securities

- Section 391 SFO – imposes civil liability for false or misleading public communications

- Section 107 SFO – imposes criminal liability for making any fraudulent or reckless misrepresentation to induce others to deal in securities

- Section 298 SFO – imposes criminal liability for disclosure of false or misleading information to induce dealings

- Section 384 SFO – imposes criminal liability for provision of false or misleading information in a prospectus or other document filed with the Exchange or the SFC

Liability can also arise: (i) under the Misrepresentation Ordinance or the Theft Ordinance; (ii) in tort; or (iii) under contract.

For further information, please see Charltons’ note “Potential Liabilities under Hong Kong Law in Connection with the Publication of a Prospectus on the Listing of a Company on the Stock Exchange of Hong Kong”.

RESTRICTION ON DISCLOSURE OF MATERIAL INFORMATION TO ANALYSTS

The Hong Kong prospectus is the sole document by which the Company sells its shares in the Hong Kong IPO.

Any other additional document by which securities are offered to the public (or members of the public) could constitute a “prospectus” under Hong Kong law, in which case:

- the prospectus content requirements will apply;

- the translation requirements will apply; and

- the registration requirement will apply.

Breach of the prospectus laws is a criminal offence.

- To avoid the risk of liability, the directors and senior management of the Company must ensure that no material information about the Company or its securities is provided to any investment research analyst, unless the information is reasonably expected to be included in the prospectus or is publicly available.

- When assessing whether any such information is “material” information, the test that should be applied is whether the information is material to an investor in forming a valid and justifiable opinion of the Company and its financial condition and profitability.

- This restriction covers any information provided to an analyst, directly or indirectly, formally or informally, in writing or verbally. It covers all communications in a meeting, during a presentation, site visit or interview, or in any other context.

It is of utmost importance that no additional material non-public information is provided to other persons, including analysts.

- In case of disclosure (whether intentional or not) to analysts, the Company may be compelled to disclose the same information in the prospectus;

- Such information may not be appropriate for a prospectus and may not be verifiable.

Consequences of putting such a statement in the prospectus

- any untrue statement (including any statement that is false, misleading or deceptive) in a prospectus may give rise to criminal and civil liability, including personal liabilities of each director and any other person who authorised the issue of the prospectus; and

- the directors must likewise take personal liability for the truthfulness, accuracy and completeness of any information the Company may be compelled under the SFC rules to insert into the prospectus under the above circumstances.

- The restriction covers any information provided to an analyst, directly or indirectly, formally or informally, in writing or otherwise.

The Company is strongly advised to seek the guidance and assistance of its sponsor(s), its Hong Kong legal advisers and those of the sponsor if there are any uncertainties.

RESTRICTION ON FUNDAMENTAL CHANGE IN THE NATURE OF THE BUSINESS IN 12 MONTHS AFTER LISTING

In the first 12 months after dealings in an issuer’s securities commence on GEM, an issuer is prohibited from entering into any transaction or arrangement which would result in a fundamental change to its principal business activities or those of its group.

The Exchange may grant a waiver of this prohibition if the circumstances are exceptional and the transaction or arrangement is approved by the shareholders in general meeting by a resolution on which any controlling shareholder (or if there are no controlling shareholders, any chief executive or directors (other than INEDs) of the listed issuer) and their respective associates are required to abstain from voting in favour. Shareholders with a material interest in the transaction and their associates are also required to abstain from voting on the transaction.

RESTRICTION ON DISPOSALS BY CONTROLLING SHAREHOLDERS FOLLOWING LISTING

The Listing Rules impose restrictions on the disposal of securities by a controlling shareholder following a company’s new listing. Any person shown by the listing document to be a controlling shareholder of the issuer at the time of listing must not:

- dispose of, or enter into any agreement to dispose of, or create any options, rights, interests or encumbrances in respect of, any shares which the listing document shows to be beneficially owned by him in the period commencing on the date on which disclosure of the shareholding is made in the listing document and ending 6 months from the date on which dealings in the securities of the new applicant commence on the Exchange; or

- dispose of, or enter into any agreement to dispose of, or create any options, rights, interests or encumbrances in respect of, any shares which the listing document shows to be beneficially owned by him if such disposal would result in him ceasing to be a controlling shareholder in the period of 6 months commencing on the date on which the period referred to in (i) above expires

There are exceptions to the above prohibitions on disposals by controlling shareholders for:

- pledges or charges of shares created in favour of an authorised financial institution (as defined in the Banking Ordinance) as security for a bona fide commercial loan;

- disposals made pursuant to a power of sale under a pledge or charge referred to at (i) above;

- disposals on the death of a controlling shareholder or in other exceptional circumstances approved by the Exchange.

Controlling shareholders must however immediately inform the issuer if they pledge or charge any of their shares in favour of an authorised institution or pursuant to a waiver granted by the Exchange during the period commencing on the date by reference to which the shareholding is disclosed in the listing document and ending 12 months from the date on which dealings commence on the Exchange.

STATUTORY REGIME FOR INSIDE INFORMATION DISCLOSURE – KEY FEATURES

- A statutory obligation under Part XIVA SFO on corporations to disclose inside information to the public as soon as reasonably practicable after inside information has come to their knowledge;

- Breaches of the disclosure requirement will be dealt with by the MMT;

- A number of civil sanctions will be imposed incl. a maximum fine of HK$ 8 million on the corporation, its directors/chief executive;

- The SFC has published Guidelines on Disclosure of Inside Information (SFC Guidelines) to assist compliance with the new requirements;

- SFC can institute proceedings directly before the MMT (without referral to the Financial Secretary);

- The application of an objective test in determining whether information is inside information: whether a reasonable person, acting as an officer of the corporation, would consider that the information is inside information in relation to the corporation.

- Statutory obligation to disclose inside information as soon as reasonably practicable upon knowledge.

- An obligation on directors and officers to take reasonable measures to ensure proper safeguards exist to prevent corporations’ breach of statutory requirements.

- Individual liability on directors/officers for corporation’s breach of the requirement if such breach is a result of their intentional, reckless or negligent conduct or failure to ensure proper safeguards.

- The provision of “safe harbours” for legitimate circumstances where non-disclosure or late disclosure is permitted.

- The SFC can investigate suspected breached and to institute proceedings before the MMT.

- Civil sanctions: a fine up to HKD 8 million or disqualification order up to 5 years.

- Liability to pay compensation to persons who suffer financial loss as a result of the breach.

DEFINITION OF “INSIDE INFORMATION”

Section 307A SFO

Specific information that is about:

- the listed corporation;

- a shareholder or officer of the listed corporation; or

- the listed securities of the corporation or their derivatives; and

- is not generally known to that segment of the market which deals or would be likely to deal in the listed securities of the corporation but would, if generally known, be likely to have a material effect on the price of the corporation’s securities.

Key elements of the definition

- The three key elements of the definition are that:

- the information must be specific;

- the information must not be generally known to that segment of the market which deals or which would likely deal in the corporation’s securities; and

- the information would, if generally known, be likely to have a material effect on the price of the corporation’s securities;

- SFC guidelines provide guidance on interpretation.

Specificity of Information

- The information must be capable of being identified, defined and unequivocally expressed

- The information need not be precise; information may be specific even though the particulars or details are not precisely known

- Information on a transaction that is only contemplated or under negotiation, while not yet subject to a final agreement, can be specific information

- Mere rumours, vague hopes, or worries, wishful thinking and unsubstantiated conjecture are not specific information

Generally known to the market

- Rumours, media speculation and market expectation about an event cannot be equated with information generally known to the market.

- Clear distinction drawn between market having actual knowledge through proper disclosure and speculation/expectation on an event which require proof.

- Where information is the subject of media comments/analysts’ reports, the corporation should consider the accuracy/completeness/reliability of the information in determining whether it is “generally known to the market”.

- Should material omissions/doubts as to its bona fides exist, the information is not generally known to the market and requires full disclosure.

Likely to have a material effect on the price of listed securities

- Test: whether the inside information would influence persons who are accustomed to or would be likely to deal in the corporation’s shares, in deciding whether to buy or sell the securities

- The test is necessarily a hypothetical one since it must be applied at the time the information becomes available.

TIMING OF DISCLOSURE

Inside information has come to the corporation’s knowledge if:

- the inside information has, or ought reasonably to have, come to the knowledge of an officer of the corporation in the course of performing functions as an officer of the corporation; and

- a reasonable person, acting as an officer of the corporation, would consider that the information is inside information in relation to the corporation (section 307B(2) SFO).

Corporations must therefore have effective systems and procedures in place to ensure that any material information which comes to the knowledge of any of their officers is promptly identified and escalated to the board to determine whether it needs to be disclosed.

MEANING OF “AS SOON AS REASONABLY PRACTICABLE”

According to the SFC Guidelines, the corporation should immediately take all steps necessary to disclose the information to the public, which may include:

- Ascertaining sufficient details;

- Internal assessment of the matter and its impact;

- Seeking professional advice; and

- Verification of the facts

The corporation must ensure that the information is kept strictly confidential until it is publicly disclosed. If the corporation believes that confidentiality cannot be maintained or has been breached, it should immediately disclose the information.

SFC also raises the possibility for corporation to issue “holding announcement” to give the corporation time to clarify the details and likely impact of an event before full announcement.

WHO IS AN “OFFICER”?

- Officer: a director, manager or company secretary of a corporation or any other person involved in its management (Part 1 of Schedule 1 to the SFO).

- For the purpose of the inside information regime, “manager” generally connotes a person who, under the immediate authority of the board, is charged with management responsibility affecting the whole or a substantial part of the corporation.

- The formulation “in course of performing functions as an officer of the corporation” implies that only information being known in situations where the officer is acting in capacity as an officer is subject to the new PSI disclosure requirement.

MANNER OF DISCLOSURE

- Disclosure must be made in a manner that can provide equal, timely and effective access by the public (s307C(1) SFO).

- Publication via the electronic publication system operated by the Exchange will meet the above requirements (s307C(2)).

- On top of publication via the Exchange, press releases issued through news, wire services, press conferences in HK and/or posting an announcement on the corporation’s own websites are also allowed.

- If a corporation is listed on more than one stock exchange, the corporation must ensure information disclosed in overseas markets is simultaneously disclosed in HK. If the HK market is closed, the corporation must issue an announcement in HK before the HK market opens.

- If necessary, the corporation can request a suspension of trading

- The information contained in the disclosure announcement must be complete and accurate in all material respects and not be misleading or deceptive.

THE SAFE HARBOURS

- Safe Harbours: 4 situations where corporations are permitted not to disclose or delay disclosing inside information (s307D SFO).

- Except for Safe Harbour A, corporations may only rely on the safe harbours if they have taken reasonable precautions to preserve the confidentiality of the inside information and the inside information has not been leaked.

Safe Harbour A

Corporations are granted safe harbour if disclosure would breach an order by a HK court or any provisions of other HK statutes.

Safe Harbour B

Corporations are granted safe harbour for information relating to an incomplete proposal or negotiation.

Examples:

- when a contract is being negotiated but has not been finalised;

- when a corporation decides to sell a major holding in another corporation;

- when a corporation is negotiating a share placing with a financial institution; or

- when a corporation is negotiating the provision of financing with a creditor.

Safe Harbour C

Corporations are granted safe harbour for information being a trade secret. Trade secret generally refers to proprietary information owned by a corporation:

- used in a trade or business of the corporation;

- which is confidential (i.e. not already in the public domain);

- which, if disclosed to a competitor, would be liable to cause real or significant harm to the corporation’s business interests; and

- the circulation of which is confined to a limited number of persons on a need-to-know basis.

Trade secrets may concern inventions, manufacturing processes or customer lists. However a trade secret does not cover the commercial terms and conditions of a contractual agreement or the financial information of a corporation.

Safe Harbour D

Corporations are granted safe harbour for information concerning the provision of liquidity support from the Government’s Exchange Fund or a Central Bank (or institution performing such functions, inside or outside HK).

The purpose of this safe harbour is to ward off financial contagion.

Safe harbour condition of confidentiality:

Except for Safe Harbour A, the safe harbours are only available if and so long as:

- Reasonable precautions for preserving confidentiality are taken; and

- The confidentiality is preserved.

If confidentiality is lost or information leaked, the safe harbour will cease to be available and disclosure is required as soon as practicable.

If confidentiality is lost, the corporation will not be regarded as in breach of the disclosure requirement in respect of inside information if it can show that it:

- has taken reasonable measures to monitor the confidentiality of information in question; and

- made disclosure as soon as reasonably practicable.

SFC’s POWER TO GRANT WAIVER

- The SFC can grant waivers where the disclosure of inside information in Hong Kong would be prohibited under a court order or legislation of another jurisdiction or would contravene a restriction imposed by a law enforcement agency or government authority in another jurisdiction (section 307E(1)SFO). The SFC will grant waivers on a case-by-case basis and may attach conditions.

- During an application for a waiver, confidentiality must be maintained. Should an information leakage occur, the corporation would be obliged to suspend trading prior to making a disclosure. The waiver application fee will be HK$24,000.

- A corporation must copy to the Exchange any application to the SFC for a waiver from the disclosure obligation and the SFC’s decision when received.

LIABILITY OF OFFICERS UNDER THE NEW REGIME

The officers of a corporation are required to take all reasonable measures to ensure that proper safeguards exist to prevent the corporation’s breach of the inside information disclosure requirement (section 307G(1)).

Although an officer’s breach of this provision is not actionable of itself, an officer will be regarded as having breached the inside information disclosure obligation if the listed corporation has breached such obligation and either:

- the breach resulted from the officer’s intentional, reckless or negligent conduct; or

- the officer has not taken all reasonable measures to ensure that proper safeguards exist to prevent the breach (section 307G(2) SFO).

The SFC Guidelines focus on the responsibility of officers, including non-executive directors, to ensure that appropriate systems and procedures are put in place and reviewed periodically to enable the corporation to comply with the disclosure requirement. Officers with an executive role will also have a duty to oversee the proper implementation and functioning of the procedures and to ensure the detection and remedy of material deficiencies in a timely manner.

SANCTIONS

Possible penalties imposed by the MMT:

- a fine of up to HK$8 million on the corporation, a director or chief executive (but not officer);

- disqualification of the director or officer for up to 5 years;

- a “cold shoulder” order on the director or an officer for up to 5 years;

- a “cease and desist” order on the corporation, director or officer;

- an order that any body of which the director or officer is a member be recommended to take disciplinary action against him; and

- payment of costs of the civil inquiry and/or the SFC investigation by the corporation, director or officer.

To prevent the occurrence of further breaches, the MMT may require:

- the appointment of an independent professional adviser to review the corporation’s procedures for disclosure of PSI and advise it on matters relating to compliance; and

- the officer to undertake a training programme approved by the SFC on compliance with Part XIVA SFO, directors’ duties and corporate governance.

CIVIL LIABILITY – PRIVATE RIGHT OF ACTION

A corporation or officer found to be in breach of the statutory disclosure obligation may be found liable to pay compensation to any person who has suffered financial loss as a result of the breach in separate proceedings brought by such person under Section 307Z SFO.

The corporation or officer will be liable to pay damages provided that it is fair, just and reasonable that it/he should do so. A determination by the MMT that a breach of the disclosure requirement has taken place or identifying a person as being in breach of the requirement will be admissible in evidence in any such proceedings to prove that the disclosure requirement has been breached or that the person in question has breached that requirement.

The courts may also impose an injunction in addition to or in substitution for damages.

LISTING RULE DISCLOSURE OBLIGATIONS

The role and duties of the SFC and the Exchange

The SFC is responsible for the enforcement of the statutory disclosure regime, but the Exchange will remain responsible for maintaining an orderly, informed and fair market.

The Exchange will not give any guidance as to the interpretation or operation of Part XIVA of the SFO or the Guidelines on Disclosure of Inside Information published by the SFC.

An issuer will not face enforcement action by the SFC and the Exchange at the same time, in respect of the same set of facts.

The Exchange will refer cases of possible breach of the statutory disclosure obligation to the SFC when the Exchange becomes aware of it.

The Exchange will not take disciplinary action unless the SFC considers it inappropriate to pursue the matter under the SFO and the Exchange considers there to have been a breach of the Listing Rules.

Obligation to avoid false market (GEM Rule 17.10(1))

- If it is the Exchange’s view that there is, or is likely to be, a false market in a listed issuer’s securities, the issuer must announce the information necessary to avoid a false market as soon as reasonably practicable after consultation with the Exchange.

- An issuer is also required to contact the Exchange as soon as reasonably practicable if it believes that there is likely to be a false market in its securities.

- Under GEM Rule 17.10(2), where an issuer is required to disclose inside information under the SFO, it must simultaneously announce the information. An issuer is also required to simultaneously copy to the Exchange any application to the SFC for a waiver from the requirement to disclose PSI and to promptly copy to the Exchange the SFC’s decision whether to grant such a waiver.

Obligation to respond to the Exchange’s enquiry

- GEM Rule 17.11 requires an issuer that receives an enquiry concerning unusual movements in the price or trading volume of an issuer’s listed securities, the possible development of a false market in its securities, or any other matters from the Exchange, must respond promptly in one of two ways:

- provide (and announce, if so required by the Exchange) any information it has that is relevant to the subject matter of the enquiry, so as to inform the market or to clarify the situation; or

- if appropriate and if requested by the Exchange, issue a standard announcement confirming that the directors, having made such enquiry with respect to the issuer as may be reasonable in the circumstances, are not aware of any information that is or may be relevant to the subject matter of the enquiry or of any inside information that needs to be disclosed under the SFO.

- The latter response should be made in a standard form that is set out in Note 1 to the revised GEM Rule 17.11.

“This announcement is made at the request of The Stock Exchange of Hong Kong Limited.

We have noted [the recent increases/decreases in the price [or trading volume] of the [shares/warrants] of the Company] or [We refer to the subject matter of the Exchange’s enquiry]. Having made such enquiry with respect to the Company as is reasonable in the circumstances, we confirm that we are not aware of [any reasons for these price [or volume] movements] or of any information which must be announced to avoid a false market in the Company’s securities or of any information which must be announced to avoid a false market in the Company’s securities or of any inside information that needs to be disclosed under Part XIVA of the Securities and Futures Ordinance.

This announcement is made by the order of the Company. The Company’s Board of Directors collectively and individually accept responsibility for the accuracy of this announcement.”

- A note to GEM Rule 17.11 – an issuer does not need to disclose inside information under the Rules if the information is exempted from disclosure under the statutory regime as set out in Part XIVA SFO.

TRADING HALTS OR SUSPENSION

GEM Rule 17.11A requires an issuer to request a trading halt or trading suspension if an announcement cannot be made promptly in any of the following circumstances:

- where an issuer has information which must be disclosed under the GEM Rule 17.10;

- an issuer reasonably believes that there is inside information which must be disclosed under the statutory disclosure obligation under Part XIVA of the SFO; or

- circumstances exist where it reasonably believes or it is reasonably likely that confidentiality may have been lost in respect of inside information which is : (i) the subject of an application to the SFC for a waiver; or (ii) exempt from the statutory disclosure obligation (except if the exemption concerns disclosure prohibited by Hong Kong law/court order).

“Trading halts” are defined as an interruption of trading in an issuer’s securities requested or directed pending disclosure of information under the Rules

Under GEM Rule 9.04, the Exchange also has the right to direct a trading halt or suspend dealings in an issuer’s securities in a number of circumstances including where:

- there are unexplained movements in the price or trading volume of the issuer’s listed securities or where a false market for the trading of such securities has developed and the issuer’s authorised representative cannot immediately be contacted to confirm that the issuer is not aware of any matter that is relevant to the unusual price movement or trading volume or the development of a false market;

- the issuer delays in issuing an announcement in response to enquiries from the Exchange under GEM Rule 17.11; or

- there is uneven dissemination or leakage of inside information in the market giving rise to an unusual movement in the price or trading volume of the issuer’s listed securities.

ANNOUNCEMENTS

The Listing Rules require listed companies to publish announcements in a wide range of situations. The Exchange’s Guide on Pre-vetting Requirements and Selection of Headline Categories for Announcements (“Pre-Vetting Guide”)[1] (attached at Attachment C) sets out the situations in which an announcement is required under the GEM Rules, whether or not the announcement is required to be vetted by the Exchange before publication and the headline categories which will generally apply. The following is a summary of the main situations in which a listed issuer is required to publish an announcement.

- Price-sensitive information – any price-sensitive information which is discloseable as inside information under Part XIVA SFO must be announced and kept strictly confidential until a formal announcement is made.

- Notifiable transactions – any notifiable transaction within Chapter 19 of the GEM Rules.

- Connected transactions – any connected transaction (unless an exemption is available) within Chapter 20 of the GEM Rules.

Advances and financial assistance to third parties – the listed issuer or any of its subsidiaries makes a “relevant advance to an entity” which:

- exceeds 8% of the total assets of the listed issuer (GEM Rule 17.15); or

- is greater than the previously disclosed relevant advance by 3% or more of the listed issuer’s total assets (GEM Rule 17.16).

The expression “relevant advance to an entity” means the aggregate of amounts due from and all guarantees given on behalf of an entity, its controlling shareholder, its subsidiaries, its affiliated companies and any other entity with the same controlling shareholder as itself. An advance to a subsidiary of the listed issuer, or between subsidiaries of the listed issuer, is not regarded as a relevant advance to an entity.

Financial assistance to affiliated companies – where financial assistance and guarantees of financial assistance given by the listed issuer or any of its subsidiaries to affiliated companies (being those which are equity accounted for by the issuer) of the listed issuer together exceed 8% of the listed issuer’s total assets (GEM Rule 17.18).

Pledge of controlling shareholder’s interest – where the controlling shareholder of the listed issuer has pledged its interest in shares of the issuer to secure debts of the issuer or to secure guarantees or other support of obligations of the issuer (GEM Rule 17.19).

Loan agreements – where:

- the listed issuer (or any of its subsidiaries) enters into a loan agreement that imposes specific performance obligations on any controlling shareholder (e.g. a requirement to maintain a specified minimum holding in the share capital of the listed issuer) and breach of such obligation will cause a default in respect of loans that are significant to the operations of the listed issuer (GEM Rule 17.20); or

- the listed issuer or any of its subsidiaries breaches the terms of a loan that is significant to the operations of the group, such that the lender may demand immediate repayment and the breach has not been waived by the lender (GEM Rule 17.21).

Takeover offers – an announcement must be made once a takeover offer is made or accepted, as required by the Takeovers Code

Accounts and auditors

Board meeting for approval of results – an issuer must inform the Exchange and publish an announcement at least 7 clear business days in advance of the date fixed for any board meeting at which the profits or losses for any period are to be approved for publication (GEM Rule 17.48).

Annual, half-year and quarterly results – must be published by way of announcement under Chapter 18 of the GEM Rules.

Change in auditor or financial year end – any change in a listed issuer’s auditors or financial year end, the reason(s) for the change and any other matters that need to be brought to the attention of holders of the company’s securities. The issuer’s announcement must state whether the outgoing auditors have confirmed that there are no matters that need to be brought to the attention of holders of the company’s securities (GEM Rule 17.50(4)).

The issuer must appoint an auditor at each annual general meeting (AGM) to hold office until the next AGM. Any proposal to remove an auditor before the end of its term of office must be approved by shareholders in general meeting (GEM Rule 17.100).

Company matters

Change of company name – once the board decides to change the company name (Schedule to Appendix 24 of the GEM Rules).

Memorandum and Articles of Association – any proposed alteration of the memorandum or articles of association (or equivalent documents) of the listed issuer (GEM Rule 17.50(1)).

Registered office – any change in the company’s registered address, agent for service of process in Hong Kong or registered office or registered place of business in Hong Kong (GEM Rule 17.50(5)).

Share registrar – any change of the company’s share registrar (including any overseas branch share registrar) (GEM Rule 17.50(3)).

Dividends – an issuer must inform the Exchange and publish an announcement at least 7 clear business days in advance of the date fixed for any board meeting at which the declaration, recommendation or payment of a dividend is expected to be decided (GEM Rule 17.48). Any decision of the board to declare, recommend or pay a dividend or not to do so must be announced immediately, and include the rate, amount and expected payment date (GEM Rules 17.49(1) and (2)).

Change in nature of business – a proposed fundamental change in the issuer’s/group’s principal business activities must be announced immediately after it is the subject of any decision (GEM Rule 17.25).

Winding-up or Liquidation – the appointment of a receiver or manager, the presentation of any winding-up petition or the passing of any resolution authorising the winding up of the listed issuer, its holding company or any of its major subsidiaries (i.e. a subsidiary representing 5% under any of the percentage ratios (discussed in “Notifiable Transactions” later) or any similar insolvency events (GEM Rule 17.27(1)).

Decision to withdraw listing – a proposed withdrawal of listing must be notified to shareholders by way of publication of an announcement (GEM Rule 9.23).

Corporate governance

Audit committee – if the issuer fails to set up an audit committee or does not meet the membership requirements (GEM Rule 5.33). An announcement must be published of any change in membership of the audit committee (GEM Rule 17.50(3)).

Remuneration committee – if the issuer fails to set up a remuneration committee or does not comply with the requirements as to its composition or terms of reference (GEM Rule 5.36).

Directors and officers

Board composition and independent non-executive directors – an announcement must be made if number of the issuer’s INEDs is less than three or one third of the number of directors on the board, or if it does not have at least one INED with appropriate professional qualifications or accounting or related financial management expertise (GEM Rule 5.06).

Change in company secretary – an announcement must be made once the board has decided to change the company secretary (GEM Rule 17.50(3)).

Change in compliance adviser – an announcement must be made as soon as a compliance adviser resigns, and arrangements must be made immediately to appoint a new compliance adviser. Once a new compliance adviser has been appointed, another announcement must be made (GEM Rules 17.50(3) and 6A.29).

Change in compliance officer – an announcement must be published of any change to the issuer’s compliance officer (GEM Rule 17.50(3)) or if the issuer does not have a compliance officer (GEM Rule 5.23).

Change in directors or supervisors – any change of directors, including, in the case of the resignation of a director, the reasons given by the director for his resignation (GEM Rule 17.50(2)). An announcement of the appointment of a new director or re-designation of a director must include the information specified in GEM Rule 17.50(2).

Change in disclosed information about directors – any change to the information specified in paragraphs (h) to (v) of GEM Rule 17.50(2) previously disclosed about a director must be announced (GEM Rule 17.50A). Such information relates mainly to matters which may cast doubt on the integrity of the directors involved and their suitability for continuing to serve as directors. Any change in the information specified in paragraphs (a) to (e) and (g) of GEM Rule 17.50(2) must be set out in the next published annual or interim report. The Rules include an obligation for directors to inform the issuer immediately of any information specified in GEM Rule 17.50(2) and any change to such information (GEM Rule 17.50B).

Meetings

Notice of general meetings – notice of an issuer’s annual general meeting and other general meetings must be announced (GEM Rules 17.44 and 17.46(2)).

Results of general meetings – the results must be published before commencement of trading on the business day following the meeting (GEM Rule 17.47(5)).

Shares

Issues of securities – an issue of securities (including convertible securities or warrants, options or similar rights) will almost always require an announcement (except an exercise of options under an employee share scheme) either as inside information under GEM Rule 17.10(2)(a), or under Chapter 19 or 20, or under GEM Rule 17.30.

Changes in number of issued shares – certain changes in the number of issued shares must be reported to the Exchange for publication on the Exchange’s website on the following business day (GEM Rule 17.27A). Issuers must also submit a monthly return of changes in its equity securities, debt securities and other securitised instruments (GEM Rule 17.27B).

Share option schemes – an employee share option scheme must be approved by shareholders in general meeting and a listed issuer must publish an announcement of the outcome of the meeting as soon as possible and no later than the business day following the meeting (GEM Rule 23.02(1)(a)). Further announcements must be published on the grant of share options pursuant to a share option scheme specifying the information required by GEM Rule 23.06A.

Basis of allotment of securities – the basis of allotment of any securities offered to the public for subscription or sale or an open offer and of the results of the offer and, if applicable, of the basis of any acceptance of excess applications. The company must notify the Exchange of such matters no later than the morning of the next business day after the allotment letters or other relevant documents of title are posted (GEM Rule 16.13).

Public float – The company must inform the Exchange immediately and publish an announcement if it becomes aware that the number of its listed securities held by the public has fallen below the prescribed minimum percentage (i.e. 25% unless a lower percentage of between 15% and 25% was approved by the Exchange on listing for a company having an expected market capitalisation at the time of listing of more than HK$10 billion) (GEM Rules 11.23(7), 11.23(10) and 17.36).

Share Repurchases – any purchase, sale, drawing or redemption by the issuer or its group members of its listed securities (whether on the Exchange or not) (GEM Rule 17.35). The company should also be aware of the provisions of the Code on Share Buy-backs which sets out detailed rules governing any offer to purchase, redeem or otherwise acquire the shares of a listed issuer made by or on behalf of the listed issuer to any of its shareholders.

Announcements which Require Pre-vetting by the Exchange

Announcements of the following matters or transactions must be submitted to the Exchange for review and approval before publication under GEM Rule 17.53(2):

- very substantial acquisitions, very substantial disposals or reverse takeovers under GEM Rules 19.34 and 19.35;

- transactions or arrangements within 12 months after listing which would result in a fundamental change in principal business activities under GEM Rules 19.88 to 19.90; and

- matters relating to cash companies under GEM Rules 19.82 and 19.83.

Announcements other than those specified in GEM Rule 17.53(2) do not need to be pre-vetted by the Exchange, although companies may consult the Exchange regarding rule compliance issues. The Exchange also reserves the right under GEM Rule 17.53A to require listed companies to submit for review any draft announcement, circular or other document in individual cases.

For a summary of the pre-vetting requirements for announcements, reference should be made to the Exchange’s Pre-vetting Guide at Attachment C.

MATTERS REQUIRING PRIOR CONSULTATION WITH EXCHANGE PRIOR TO ANNOUNCEMENT

There are a number of Rule compliance issues relating to notifiable transactions or issues of securities which need the Exchange’s prior consent or confirmation prior to publication of an announcement. These include, but are not limited to, the following:

- whether the Exchange will allow the listed issuer to adopt alternative size test(s) to classify a transaction under GEM Rule 19.20;

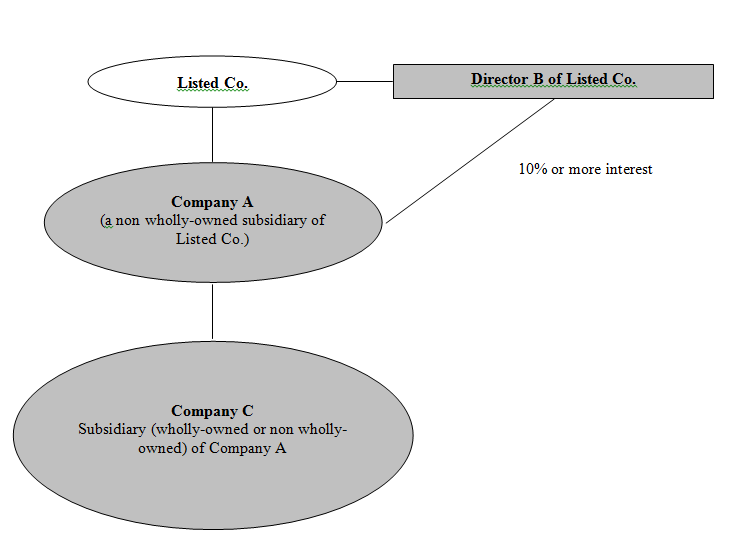

- whether the Exchange will deem a party to a transaction to be a connected person of the listed issuer under GEM Rules 20.17 to 20.19. GEM Rule 20.20 requires a listed issuer to notify the Exchange of any proposed transaction with the party described in such rules unless a transaction is exempt;

- whether the transaction/matter falls under the special or exceptional circumstances described in the Listing Rules, e.g. a proposed issue of securities for cash under general mandate at a price representing a discount of 20% or more to the benchmarked price under GEM Rule 17.42B; or a proposed issue of warrants that would not meet certain specific requirements under GEM Rule 21.02; and

- In the case of matters affecting trading arrangements (including suspension or resumption of trading, and cancellation or withdrawal of listing), GEM Rule 17.53B requires that:

- listed issuers must consult the Exchange before issuing the relevant announcement; and

- the announcement must not include any reference to a specific date or timetable which has not been agreed in advance with the Exchange.

Publication of Announcements

- Announcements must be published on the GEM website and on the listed issuer’s own website.

- Listed companies must submit an electronic copy of the announcement through the Exchange’s electronic submission system (HKEx-EPS).

- When doing so, companies must select all appropriate headlines from the list of headline categories which are set out in Appendix 17 to the GEM Rules.

- Unless stated otherwise in the Rules, all announcements must be published in both English and Chinese.

With the exception of certain limited types of announcements that can be published at all times during the operational hours of the e-Submission System, announcements must only be submitted during the designated publications windows which are:

On a normal business day:

- 6.00 a.m. to 8.30 a.m.

- 12.00 p.m. to 12.30 p.m.

- 4.15 p.m. to 11.00 p.m.

On the eves of Christmas, New Year and Lunar New Year when there is no afternoon session:

- 6.00 a.m. to 8.30 a.m.

- 12.00 p.m. to 11.00 p.m.

The categories of announcements which can be published during trading hours as well as outside trading hours are:

- suspension announcements;

- announcements made in response to unusual movements in share price or trading volume;

- announcements denying the accuracy of news reports or clarifying that only its published information should be relied upon; and

- overseas regulatory announcements.

LISTING DOCUMENTS AND CIRCULARS WHICH REQUIRE PRE-VETTING

GEM Listing Rule 17.53(1) requires the following documents to be submitted to the Exchange for review and approval before publication:

- listing documents (including prospectuses);

- circulars relating to cancellation or withdrawal of listing of listed securities;

- circulars for notifiable transactions which are subject to shareholders’ approval;

- circulars for connected transactions;

- circulars to the company’s shareholders seeking their approval of issues of securities that require specific mandates from the shareholders (under GEM Rules 17.39 and 17.40);

- circulars to the issuer’s shareholders seeking their approval of transactions or arrangements that require independent shareholders’ approval and the inclusion of separate letters from independent financial advisers to be contained in the relevant circulars under GEM Rule 17.47(7), which include:

- spin-off proposals;

- transactions which the Rules require to be subject to independent shareholders’ approval (see GEM Rule 17.47(5)(b)) such as:

- rights issues under GEM Rule 10.29;

- open offers under GEM Rule 10.39;

- refreshments of general mandates before next AGM under GEM Rule 17.42A;

- withdrawal of listings under GEM Rule 9.20; and

- transactions or arrangements that would result in a fundamental change in the principal business activities of the listed issuer within 12 months after listing under GEM Rules 19.88 to 19.90;

- circulars to the issuer’s shareholders seeking consent to an allotment of voting shares that will alter the control of the issuer (under GEM Rule 17.40)

- circulars to shareholders seeking their approval of any matter in relation to a share option scheme which is required under Chapter 23 of the GEM Listing Rules;

- circulars to shareholders seeking their approval of warrant proposals involving approvals by shareholders and all warrantholders under GEM Rule 21.07(3); and

- circulars or offer documents issued by the issuer in connection with takeovers, mergers or offers.

DISCLOSURE OF CHANGES IN THE NUMBER OF ISSUED SHARES

- Next Day Disclosure Requirements

The Listing Rules require next day disclosure on the GEM website of 2 categories of changes in number of issued shares

- The first category of changes in the number of issued shares, which always require next day disclosure on the next business day under GEM Rule 17.27A(2)(a), include those that result from the following:

- placings;

- consideration issues;

- open offers;

- rights issues;

- bonus issues;

- scrip dividends;

- repurchases of shares or other securities;

- exercise of an option (whether under a share option scheme or not) by a director of the listed issuer;

- capitalisation reorganisation; or

- change in the number of issued shares not falling within any of the categories referred to above or in GEM Rule 17.27A(2)(b).

- Categories of changes in the number of issued shares specified in GEM Rule 17.27A(2)(b) require next day disclosure in specified circumstances:

- exercise of an option under a share option scheme other than by a director of the listed;

- exercise of an option other than under a share option scheme not by a director of the listed issuer;

- exercise of a warrant;

- conversion of convertible securities; or

- redemption of shares or other securities.

- The specified circumstances include:

- where the event results in a change of 5% or more in the number of the listed issuer’s issued shares; or

- where the listed issuer is required to make disclosure of a first category change and an event has occurred but not been disclosed (either as a second category change or in a monthly return (because the 5% de minimis threshold has not been reached)).

- Monthly Return

- in relation to movements in the listed issuer’s equity securities, debt securities and any other securitised instruments during the period to which the monthly return relates

- the return must be submitted no later than 30 minutes before the earlier of the commencement of the morning trading session or any pre-opening session on the fifth business day next following the end of each calendar month

- the monthly return must be submitted irrespective of whether there has been any change in the information provided in the previous monthly return.

DISCLOSURE OF FINANCIAL INFORMATION

Annual Report and Accounts

A listed issuer must send a copy of its annual report including its annual accounts (and consolidated financial statements, if the company prepares them) together with a copy of the auditors’ report to every shareholder of the company and every holder of the company’s listed securities not less than 21 days before the date of the company’s AGM and not later than 3 months after the end of the financial year.

The annual accounts, directors’ report and auditors’ report must be prepared in both English and Chinese and must be laid before the AGM.

In the case of overseas shareholders, the company may mail the English version only provided that a statement (in English and Chinese) is included that a Chinese language version is available from the company on request.

Financial statements must include the disclosures required under the relevant accounting standards adopted as well as the information specified in Chapter 18 of the GEM Rules (“Chapter 18”), including a statement of profit or loss and other comprehensive income, a statement of financial position and information on the rates of dividend paid or proposed for each class of shares.

Annual financial statements must be prepared in accordance with Hong Kong or International Financial Reporting Standards or China Accounting Standards for Business Enterprises (“CASBE”) in the case of a Chinese issuer that has adopted CASBE (GEM Rule 18.08).

Half-year reports and accounts

- Listed companies are also required to prepare either half-year reports or summary half-year reports and must send them to the company’s shareholders and holders of the company’s listed securities within 45 days of the end of the first 6 months of each financial year.

- Half-year reports must be reviewed by the listed issuer’s Audit Committee (Note 2 to GEM Rule 18.55(9).

Quarterly Reporting

- Quarterly reporting is a mandatory obligation under GEM Rule 18.66.

- An issuer listed on the GEM must publish quarterly results and send them to the company’s shareholders and holders of their listed securities within 45 days of the end of the first and third quarters.

Preliminary Announcements of Results

A preliminary announcement of the company’s annual, half-year and quarterly results must be published on the business day after their approval by the board and:

For Annual Results

- within 3 months of the financial year end.

For Half-year and Quarterly Results

- within 45 days of the relevant period.

The announcement must be published on the websites of GEM and the issuer.

Consequences of failure to publish financial information

For GEM issuers, the Listing Rules do not provide that the Exchange will require trading in a listed issuer’s shares to be suspended if it fails to publish its financial information on time.

However, failure to publish financial information timely may be interpreted as a breach of the statutory obligation to disclose inside information under Part XIVA SFO.

FINANCIAL REPORTING FOR MINERAL COMPANIES

- Mineral Companies must include in their half-yearly and annual reports details of exploration, development and mining production activities and a summary of expenditure incurred during the relevant period (if there has been no such activities, this must be stated) (GEM Rule 18A.14)

- Note however that companies may be required to update shareholders immediately of material changes in funding requirements or exploration activity under the requirement to disclose inside information under Part XIVA SFO.

- Mineral companies must provide an annual update of their resources and/or reserves in annual reports (GEM Rule 18A.16). Updates must be prepared in accordance with the accepted reporting standard under which they were previously disclosed or, if none, in accordance with one of the recognised reporting standards. Annual updates need not be supported by a Competent Person’s Report and may take the form of a no material change statement.

- Other (non-Mineral Company) listed issuers that publicly disclose details of resources and/or reserves are also required to provide annual updates of those resources/reserves in their annual reports.

- The Exchange has published guidance on the disclosures required in the annual and interim reports of Mineral Companies and other listed issuers which publicly disclose details of their resources and/or reserves. (HKEx-GL47-13)

BOARD MEETINGS

- The board should meet regularly and board meetings should be held at least four times a year at approximately quarterly intervals (Code Provision A.1.1).

Notice to Exchange in certain circumstances

The issuer must inform the Exchange and publish an announcement on the websites of GEM and the issuer at least seven clear business days before the date of any board meeting to consider the declaration, recommendation or payment of a dividend or at which an announcement of the financial results for any period are to be approved (GEM Rule 17.48).

Voting at board meetings

Subject to certain exceptions, a director of a listed issuer may not vote on, nor be counted in the quorum for, any board resolution approving any contract or arrangement or any other proposal in which he or any of his close associates has a material interest (GEM Rule 17.48A).

Notice to Exchange after meetings

The issuer must inform the Exchange immediately of any decision:

- to declare, recommend or pay a dividend or make any other distribution on its listed securities and the rate and amount thereof;

- not to declare, recommend or pay a dividend which would otherwise have been expected;

- on preliminary announcement of profits or losses for any period; and

- on any proposed change in the capital structure, including a redemption of listed securities (GEM Rule 17.49).

Notice of general meetings

Code Provision E.1.3 in the Corporate Governance Code requires:

- at least 20 clear business days’ notice for AGMs; and

- at least 10 clear business days’ notice for all other general meetings.

Under the “comply or explain” principle underlying the Code, issuers must explain any failure to comply with these requirements in their interim and annual reports.

Notice of general meetings must be given to all shareholders whether or not their registered address is in Hong Kong (GEM Rule 17.46(1)).

An issuer must also ensure that notice of every general meeting is announced (GEM Rule 17.44).

Mandatory voting by poll on all resolutions at general meetings

- Voting by poll is mandatory on all resolutions at all general meetings (GEM Rule 17.47(4));

- Listed issuers must appoint a scrutineer (who may be the issuer’s auditors or share registrar or external accountants who are qualified to serve as auditors) to oversee the voting procedures;

- The results of the poll must be announced by the issuer as soon as possible and no later than 30 minutes before the earlier of the commencement of the morning trading session or any pre-opening session on the business day following the general meeting;

- The chairman of a general meeting is required to ensure that the detailed procedures for conducting a poll are explained and to answer any questions that are raised (Code Provision E.2.1).

Interested shareholders required to abstain from voting

- Any shareholder that has a “material interest” in a transaction or arrangement to be approved at a general meeting of shareholders is required to abstain from voting on the resolution (GEM Rule 2.26).

- Factors relevant to determining whether a shareholder has a “material interest” include:

- whether the shareholder is a party to the transaction or a close associate of such a party; and

- whether the transaction confers upon the shareholder or his associate a benefit not otherwise available to other shareholders of the issuer (GEM Rule 2.27).

PRE-EMPTION RIGHTS

Except for a pro rata offer to existing shareholders, the directors of a listed issuer are required to obtain the consent of shareholders in general meeting prior to the allotment, issue or grant of shares, securities convertible into shares or options, warrants or similar rights to subscribe for shares or such convertible securities.

A general mandate may however be obtained from shareholders at a general meeting of shareholders to issue up to

- 20% of the number of the company’s issued shares as at the date of the resolution granting the general mandate; and

- if separately authorised by the shareholders in general meeting, shares equivalent to the number of shares repurchased (up to 10% of the number of the company’s issued shares as at the date of the resolution granting the repurchase mandate).

If a share consolidate or subdivision is conducted after the approval of the issue mandate, the maximum allowable number of securities to be issued will be adjusted accordingly.

The restrictions under GEM Rules 17.39 to 17.42B do not apply to pro rata offers made to all existing shareholders excluding those resident in a place outside Hong Kong if the directors consider such exclusion necessary or expedient due to legal restrictions or requirements of any relevant regulatory authority or stock exchange in the relevant place. Directors must make enquiry as to relevant restrictions.

An EGM may be called to approve a share issue for a specific purpose.

The above restrictions apply equally to listed companies incorporated in Hong Kong and those incorporated overseas. They do not however apply to an overseas listed issuer whose primary listing is on another stock exchange which is not subject to any other statutory or other requirement giving shareholders pre-emptive rights to shareholders over further issues of shares.

RESTRICTIONS ON ISSUES OF SECURITES IN 6 MONTHS AFTER LISTING

A listed issuer is prohibited from issuing (or entering into any agreement to issue) any further shares or securities convertible into its equity securities within 6 months of the commencement of dealing in its securities on the Exchange (whether or not the issue will be completed within 6 months from commencement of dealing) except for:

- The issue of shares, the listing of which has been approved by the Exchange, under a Ch. 23 share option scheme;

- The exercise of conversion rights attaching to warrants issued as part of the IPO;

- Any capitalisation issue, capital reduction or consolidation or sub-division of shares;

- The issue of shares or securities under an agreement entered into before the commencement of dealing, the material terms of which were disclosed in the IPO prospectus; and

- The issue of any shares or securities convertible into equity securities which:

- is for the purpose of acquiring assets that would complement the issuer’s business;

- does not result in any controlling shareholder ceasing to be a controlling shareholder or result in a change of control of the issuer;

- is subject to approval from shareholders that do not have a material interest in the related transaction and are not connected persons (or their associates);

- is set out in a circular that meets the requirements of Chapter 19 of the GEM Rules and contains sufficient information for independent shareholders to make an informed judgement on the issue and related transaction (GEM Rule 17.29).

ISSUES OF SECURITIES FOR CASH

- An announcement containing the information required by GEM Rule 17.30 must be published on the next business day of the directors’ decision to issue securities for cash.

- In the case of a placing of securities for cash, securities cannot be issued under the general mandate if the price is at a discount of 20% or more to the benchmarked price of the securities (i.e. the higher of the closing price on the date of the agreement and the average closing price for the 5 trading days immediately before the earlier of:

- the date of announcement of the transaction;

- the date of the agreement; and

- the date on which the price is fixed).

An exception applies where the issuer can satisfy the Exchange that it is in a serious financial position and can only be saved by an urgent rescue operation involving the issue of new securities at a discount of 20% or more, or that other exceptional circumstances exist (GEM Rule 17.42B).

- Where securities are issued for cash under a general mandate at a discount of 20% or more, the company must publish an announcement giving details of the allottees no later than 30 minutes before the earlier of the commencement of trading or any pre-opening session on the next business day after the agreement involving the proposed issue is signed (GEM Rule 17.30A).

- If there are less than ten allottees, the announcement must include the name of each allottee (or its beneficial owner) and confirmation of its independence from the issuer.

- If there are more than ten allottees, the name of each allottee (or its beneficial owner) subscribing 5% or more of the issued securities must be stated along with a general description of all other allottees together with confirmation of their independence from the issuer.

- In calculating the 5% limit, the number of securities subscribed by the allottee, its holding company and their subsidiaries must be aggregated.

NOTIFIABLE TRANSACTIONS

Chapter 19 of the GEM Listing Rules specifies certain transactions (principally acquisitions and disposals), particulars of which have to be disclosed to the shareholders, the Exchange and the general public. In some cases, shareholders’ approval is also required. The term “listed issuer” means the listed issuer itself or its subsidiaries. Where a transaction is both “notifiable” and “connected”, the issuer must comply with both Ch. 19 and Ch.20.

A transaction is widely defined and includes:

- an acquisition or disposal of assets, including a deemed disposal

- certain transactions in relation to options to acquire or dispose of assets or to subscribe for securities

- entering into or terminating finance leases where their financial effects have an impact on the listed issuer’s balance sheet and/or profit and loss account

- entering into or terminating operating leases which, by virtue of their size, nature or number, have a significant impact on the listed issuer’s operations

- granting an indemnity or a guarantee or providing financial assistance other than to the listed issuer’s subsidiaries

- any arrangement or agreement involving the formation of a joint venture entity in any form

The definition excludes (to the extent not specifically referred to above) transactions of a revenue nature in the ordinary and usual course of business and also the issue of new securities for cash (but these are within the definition of transaction which applies for connected transactions under Ch.20).

Transactions of a “Revenue Nature”

- Relevant non-exhaustive factors include:

- whether previous transactions of same nature treated as notifiable transactions

- historical accounting treatment of previous transactions of same nature

- whether accounting treatment is in accordance with generally accepted accounting standards

- whether transaction is a revenue or capital transaction for tax purposes (Note 4 of GEM Rule 19.04(1)(g))

- Transactions involving the acquisition and disposal of properties are generally not considered to be of a revenue nature unless carried out as one of the principal activities and in the ordinary and usual course of business of the listed issuer (Note 2 to GEM Rule 19.04(1)(g))

Transactions in the “Ordinary and Usual Course of Business”

- “Ordinary and usual course of business” = the existing principal activities of the listed issuer or an activity wholly necessary for its principal activities. Financial assistance is only provided “in the ordinary and usual course of business” of (i) a “banking company” (i.e. an authorized financial institution under the Banking Ordinance) or (ii) a licensed securities house providing financial assistance on normal commercial terms for a purpose specified in GEM Rule 19.04(1)(e)(iii) (GEM Rule 19.04(8))

Classification of Notifiable Transactions

Notifiable transactions are classified using the percentage ratios calculations set out in GEM Rule 19.06.

| Transaction Type | Assets ratio | Consideration ratio | Profits ratio | Revenue ratio | Equity capital ratio |

| Share transaction | less than 5% | ||||

| Discloseable transaction | 5% or more but less than 25% | ||||

| Major transaction – disposal | 25% or more, but less than 75% | Not Applicable | |||

| Major transaction – acquisition | 25% or more, but less than 100% | ||||

| Very Substantial Disposal | 75% or more | Not applicable | |||

| Very Substantial Acquisition | 100% or more | ||||

Note: The equity capital ratio relates only to an acquisition (and not a disposal) by a listed issuer issuing new equity capital.

Chapter 19 sets out six categories of notifiable transactions:

- A share transaction is an acquisition of assets (excluding cash) by a listed issuer where the consideration includes securities for which listing will be sought and where all percentage ratios are less than 5%;

- A discloseable transaction is a transaction or a series of transactions by a listed issuer where any percentage ratio is 5% or more, but less than 25%;

- A major transaction is a transaction or a series of transactions by a listed issuer where any percentage ratio is 25% or more, but less than 100% for an acquisition or 75% for a disposal;

- A very substantial disposal is a disposal or a series of disposals of assets by a listed issuer where any percentage ratio is 75% or more;

- A very substantial acquisition is an acquisition or a series of acquisitions of assets by a listed issuer where any percentage ratio is 100% or more; and

- A reverse takeover is “an acquisition or a series of acquisitions which, in the opinion of the Exchange, constitutes, or is part of a transaction or arrangement or series of transactions or arrangements which constitute, an attempt to achieve a listing of the assets to be acquired and a means to circumvent the requirements for new applicants set out in Chapter 11 of the GEM Listing Rules and normally refers to:

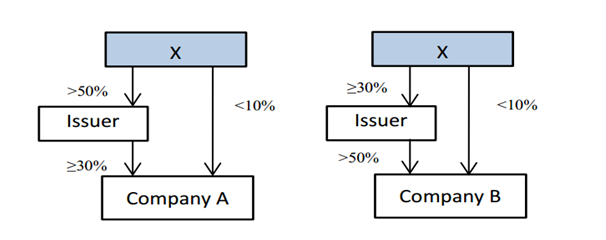

- an acquisition/series of acquisitions of assets constituting a very substantial acquisition where there is or which will result in a change in control (i.e. 30% or more of the voting rights) of the listed issuer; or

- an acquisition/series of acquisitions of assets from the incoming controlling shareholder(s) or his/their associates within 24 months after the change in control that had not been regarded as a reverse takeover, which individually or together reach the threshold for a very substantial acquisition.

- Reverse Takeovers

In determining whether an acquisition(s) constitute(s) a very substantial acquisition, the lower of:

- the latest published figures of the asset value, revenue and profits shown in the listed issuer’s accounts and the market value of the listed issuer at the time of the change in control; and

- the latest published figures of the asset value, revenue and profits shown in the listed issuer’s accounts and the market value of the listed issuer at the time of the acquisition(s),

is used as the denominator of the percentage ratios (GEM Rule 19.06(6)(b))

Percentage Ratios

To determine the category into which a transaction falls, the listed issuer must calculate the following ratios:

Intangible assets include goodwill (whether positive or negative)

| (i) Assets ratio = |

Total assets of the subject of the transaction Total assets of the listed issuer |

| Total assets = current assets + non-current assets + fixed assets + intangible assets (GEM Rule 19.04(12)) | |

| (ii) Profits ratio = |

Profits attributable to the assets of the subject of the transaction Profits of the listed issuer |

| Profits = net profits after deducting all charges except taxation and before minority interests and extraordinary items | |

| (iii) Revenue ratio = |

Revenue attributable to the assets of the subject of the transaction Total revenue of the listed issuer |

| Revenue = Revenue arising from the principal activities of a company, excluding revenue and gains that arise incidentally | |

| (iv) Consideration ratio = |

Fair value of the consideration* Total market capitalization of listed issuer** |

| *Determined at the date of the agreement according to Hong Kong Financial Reporting Standards or International Financial Reporting Standards (GEM Rule 19.15(1))

**Total market capitalization = average closing price of the listed issuer’s securities for the 5 business days preceding the transaction (GEM Rule 19.07(4)) |

|

| (v) Equity capital ratio = |

Number of shares to be issued by listed issuer as consideration Total number of the listed issuer’s issued shares immediately before the transaction |

When calculating the equity capital ratio, the numerator includes shares that may be issued upon conversion or exercise of any convertible securities or subscription rights to be issued or granted as consideration. Also, the listed issuer’s debt capital (if any), including any preference shares, is not included in the calculation.

Exception

If any size test produces an anomalous result or is inappropriate to the issuer’s sphere of activity, HKEx may substitute other relevant size indicators or industry specific tests (GEM Rule 19.20).

Classification of Transactions

Transactions involving acquisition and disposal

- Where a transaction involves both an acquisition and a disposal, the Exchange will apply the percentage ratios to both the acquisition and the disposal. The transaction will be classified based on the larger of the acquisition or disposal, and subject to the requirements applicable to that classification.

- Where a shareholders’ circular is required, each of the acquisition and disposal will be subject to the content requirements applicable to their respective transaction classification (GEM Rule 19.24).

Aggregation of transactions

The Exchange may require listed issuers to aggregate a series of transactions and treat them as if they were one transaction if they are all completed within a 12 month period or are otherwise related (GEM Rule 19.22)

Factors which the Exchange will take into account in determining whether transactions will be aggregated include whether the transactions:

- are entered into by the listed issuer with the same party or with parties connected or otherwise associated with one another;

- involve the acquisition or disposal of securities or an interest in one particular company or group of companies;

- involve the acquisition or disposal of parts of one asset; or

- together lead to substantial involvement by the listed issuer in a business activity which did not previously form part of the listed issuer’s principal business activities.

- Aggregation is not automatic only because one factor is triggered. The Exchange will also consider whether the aggregation would result in a higher transaction classification.

With regards to the aggregation of transactions, the Exchange should be consulted at an early stage:

- in cases of doubt;

- if any of the factors above apply to any transaction entered into by the listed issuer in the preceding 12-month period; or

- if any transaction entered into by the listed issuer involves acquisitions of assets from a person or group of persons or any of his/their associates within 24 months of such person or group of persons gaining control of the listed issuer (other than at the subsidiary level).

The Exchange may aggregate transactions regardless of whether it was consulted by the listed issuer.

Requirements: Summary of requirements for different categories of notifiable transactions

| Notification to Exchange | Short suspension of dealings | Publication of an Announcement | Circular to shareholders | Shareholder approval | Accountants’ report | |

| Share transaction | Yes | Yes | Yes | No | No1 | No |

| Discloseable transaction | Yes | No, unless there is PSI | Yes | No | No | No |

| Major transaction | Yes | Yes | Yes | Yes | Yes2 | Yes3 |

| Very substantial disposal | Yes | Yes | Yes | Yes | Yes2 | No5 |

| Very substantial acquisition | Yes | Yes | Yes | Yes | Yes2 | Yes4 |

| Reverse takeover | Yes | Yes | Yes | Yes | Yes2, 6 | Yes4 |

Notes:

- Shareholder approval is not required if the consideration shares are issued under a general mandate.

- Any shareholder and his associates must abstain from voting if such shareholder has a material interest in the transaction.